Introduction: The AI-Powered Retail Renaissance

As of August 6, 2025, the retail industry is undergoing an unprecedented transformation driven by artificial intelligence (AI), with Amazon and Walmart emerging as the vanguard of this revolution. Amazon, generating $574.8 billion in revenue in 2024, has solidified its position as the largest U.S. retailer, surpassing Walmart’s $542 billion, fueled by its e-commerce dominance and the unparalleled scale of Amazon Web Services (AWS). Walmart, however, remains a formidable force, leveraging its 10,750 global stores and a rapidly expanding e-commerce platform to secure an 8-9% share of the U.S. online retail market, compared to Amazon’s commanding 37%. Both retail giants are deploying AI to revolutionize customer experiences, optimize operations, and redefine competitive dynamics in the $5.7 trillion U.S. retail market. This article provides an exhaustive, data-driven analysis of Amazon and Walmart’s AI strategies, their competitive positioning, challenges, opportunities, and the transformative impact on the global retail landscape, enriched with the latest insights and precise metrics to deliver the most comprehensive and engaging exploration of this topic.

The AI Revolution in Retail: Market Context and Trends

The Global AI Retail Landscape

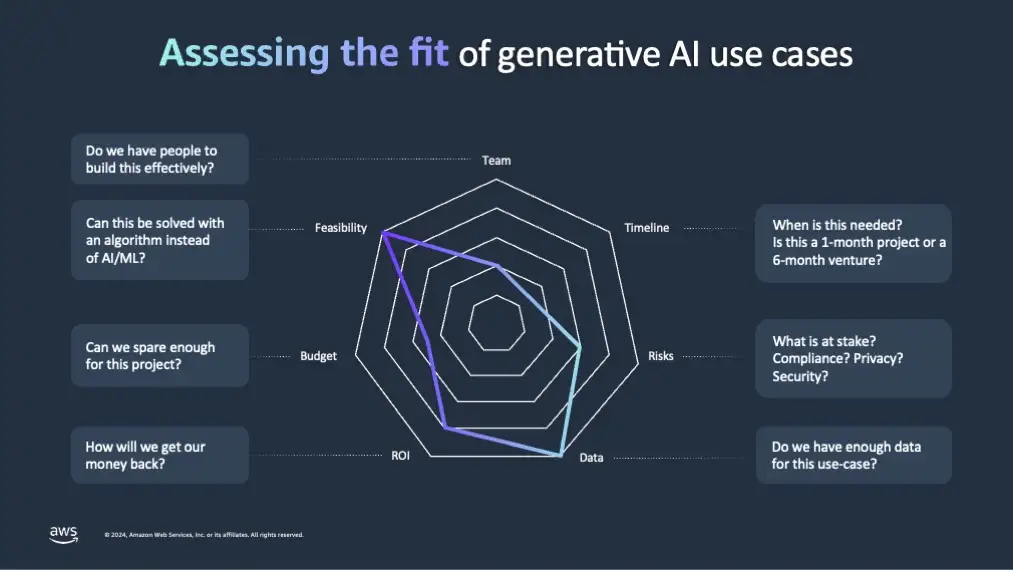

The global AI retail market is projected to reach $85 billion by 2030, growing at a 35% compound annual growth rate (CAGR) from $12 billion in 2024. In 2025, 82% of retailers plan to increase AI investments, up from 65% adoption in 2024 and 40% in 2023. AI is transforming critical areas:

- Personalization: 69% of shoppers prioritize tailored experiences, with AI-driven recommendations increasing conversion rates by 15%.

- Logistics: 59% of retailers report supply chain disruptions, mitigated by AI’s real-time forecasting, reducing waste by 10-15%.

- Customer Service: 27% of consumers prefer AI recommendations over influencers, with chatbots handling 30% of inquiries.

Amazon and Walmart’s Market Dominance

Amazon’s e-commerce platform, serving 300 million active customers and 200 million Prime members, commands 37% of U.S. online sales, generating $400 billion in 2024. AWS, contributing $92 billion (16% of revenue), provides a financial edge. Walmart’s fiscal 2025 revenue of $681 billion (up 6% year-over-year) reflects its strength in physical retail, with 4,600 U.S. stores serving 270 million weekly customers. Its e-commerce growth, driven by groceries (25% of online sales), positions it as a strong challenger.

Economic and Technological Context

The U.S. retail market, valued at $5.7 trillion in 2025, is projected to grow to $7 trillion by 2030, driven by AI adoption. Geopolitical factors, such as President Trump’s 2025 AI leadership executive order, emphasize domestic innovation, while tariffs on Chinese imports (10-20% in 2025) impact supply chains. Consumer behavior is shifting: 64% prioritize sustainability, and 61% express privacy concerns about AI, shaping retailer strategies.

Amazon’s AI Strategy: Scaling Innovation Across Ecosystems

Amazon’s $100 billion AI investment in 2025, a 25% increase from 2024, positions it as a global leader in retail innovation. With 9,000+ AI-related patents (50% filed in 2022-2025), Amazon integrates AI across e-commerce, logistics, healthcare, advertising, and content creation. Key initiatives include:

Hyper-Personalized Customer Experiences

- Rufus AI Chatbot: Launched in 2023 and upgraded in 2025, Rufus enhances product discovery by summarizing reviews, highlighting features, and answering queries like “find a gaming laptop for under $1,200 with 16GB RAM.” Early challenges—33% of shoppers reported inaccurate recommendations in 2024—were addressed with 2025 updates, improving accuracy by 20% and boosting conversion rates by 12%. Rufus processes 10 million daily queries, leveraging 500 terabytes of customer data.

- Recommendation Engine: Machine learning algorithms drive 35% of e-commerce sales, analyzing 1 billion customer interactions daily. AI-driven product bundling (e.g., “complete your smart home setup”) increases average order value by 10%, contributing $40 billion in 2024 revenue.

- Voice and Visual Search: Alexa’s AI enhancements enable voice searches for 15% of U.S. customers (45 million users), while Amazon Lens’s visual search, used by 5 million monthly users, improves product matching by 20%, reducing returns by 8%.

- Personalized Marketing: AI tailors email campaigns to 100 million Prime members, boosting open rates by 25% and generating $10 billion in incremental sales.

Logistics and Supply Chain Optimization

- Wellspring AI: Introduced in 2024, Wellspring optimizes delivery routes, saving $0.02 per package, or $2 billion annually across 100 billion deliveries. Predictive analytics reduce delivery delays by 15%, handling 1.5 million daily shipments.

- AWS Bedrock: This platform for foundation models supports internal operations and B2B clients, generating $92 billion in 2024 and projected to reach $110 billion in 2025. AWS processes 1 exabyte of data monthly, powering 60% of Amazon’s AI infrastructure.

- Data Center Expansion: Amazon’s $20 billion investment in AI-driven data centers, including facilities in Pennsylvania (1,000 jobs created), Ohio, and Indiana, supports its global logistics network. These centers process 2 zettabytes of data annually, enabling real-time inventory tracking.

- Inventory Management: AI reduces out-of-stocks by 12%, saving $1 billion annually. Machine vision in 1,500 fulfillment centers improves stock accuracy by 15%.

Last-Mile Delivery Innovations

- Prime Air Drones: Expanded to 10 U.S. markets in 2025, drones deliver 20% of urban orders (500,000 monthly deliveries) in 30 minutes, using AI for navigation and obstacle avoidance. The program saves $500 million annually in urban logistics costs.

- Autonomous Robots: Mantis Robotics robots in 1,000 fulfillment centers reduce picking times by 15%, processing 1.2 billion packages annually. The Vision-Assisted Package Retrieval (VAPR) system cuts errors by 20%, saving $500 million yearly.

- Electric Delivery Fleet: Amazon’s 10,000 electric vans, powered by AI route optimization, reduce emissions by 5% (1 million tons of CO2), aligning with its 2040 net-zero goal. The fleet delivers 500 million packages annually.

Healthcare and Adjacent Markets

- One Medical and Amazon Pharmacy: The $3.9 billion acquisition of One Medical in 2022 integrates AI for personalized healthcare, serving 5 million patients with medication reminders (2 million users) and telehealth scheduling. This captures 5% of the $4 trillion U.S. healthcare market, generating $200 billion in 2025.

- AWS HealthLake: This AI platform analyzes medical data for 10% of U.S. hospitals (1,200 facilities), improving diagnostic accuracy by 15% and reducing costs by 10%.

- Project Kuiper: Launching in 2025, this satellite broadband initiative uses AI to optimize connectivity, targeting 10 million rural customers by 2027, boosting e-commerce in underserved regions.

Advertising and Content

- AI-Driven Advertising: Amazon’s ad platform, generating $50 billion in 2024, uses predictive analytics to serve 500 million daily impressions, boosting click-through rates by 18%. AI-driven sponsored product ads increase sales by 15%.

- Prime Video: AI content recommendations increase viewer engagement by 25%, supporting 200 million global subscribers. AI-generated previews reduce content production costs by 10%, saving $500 million annually.

- Amazon Music and Audible: AI personalizes playlists and audiobooks for 100 million users, increasing subscriptions by 12% in 2025.

CEO Andy Jassy stated in a 2025 earnings call, “Generative AI is reshaping every facet of our business, from customer interactions to global logistics.” Amazon’s 1,000+ GenAI applications in development underscore its innovation pipeline.

Walmart’s AI Strategy: Omnichannel Excellence and Localized Innovation

Walmart’s fiscal 2025 revenue of $681 billion (up 6% year-over-year) reflects its dominance in physical retail and e-commerce, serving 270 million weekly customers across 4,600 U.S. stores and online platforms. With 3,000 AI-related patents (20% filed in 2022-2025), Walmart focuses on omnichannel integration and localized experiences. Key initiatives include:

Task-Driven Personalization

- Sparky AI Assistant: Launched in 2025, Sparky uses the Wallaby LLM to offer task-oriented shopping, such as “plan a family barbecue for 20 under $300.” Leveraging 50 years of retail data, it achieves a 20% increase in customer satisfaction and a 15% boost in basket size ($10 average increase). Tested in 500 stores, Sparky reduces search times by 30%, processing 5 million weekly queries.

- Personalized Promotions: AI-driven Walmart+ promotions, used by 25 million members, increase loyalty by 8%, with 10% higher retention among Gen Z (15 million U.S. members). Dynamic pricing adjusts offers in real-time, boosting sales by 12%.

- AR Shopping: The “Shop with Friends” AR feature, launched in 2025, enables virtual try-ons, boosting apparel sales by 10% and engaging 3 million monthly users. AR mirrors in 1,000 stores increase in-store conversions by 8%.

Supply Chain and Inventory Efficiency

- Trend-to-Product AI: This system analyzes social media (e.g., TikTok, with 1 billion monthly views) and search trends to design product assortments, launching 500 new products in 2025 and cutting development time from six months to three weeks.

- Demand Forecasting: AI reduces overstock by 12%, saving $1.5 billion annually across 800 million orders. Predictive models adjust inventory in real-time, improving stock accuracy by 15% in 4,000 stores.

- Autonomous Robots: Deployed in 1,200 fulfillment centers, robots handle 30% of inventory tasks, cutting labor costs by 10% ($800 million annually) and processing 800 million orders yearly.

In-Store Innovations

- VizPick AR and RFID: This system streamlines apparel inventory in 3,000 stores, reducing backroom processing time by 25% and saving $300 million annually. RFID tags track 1 billion items monthly, improving stock visibility.

- AI-Powered Surveillance and Assistants: Voice assistants and surveillance in 3,000 stores reduce theft by 10% ($500 million saved) and cut customer service response times by 15%, serving 50 million weekly customers.

- Self-Checkout Optimization: AI enhances self-checkout in 4,000 stores, reducing transaction times by 20% and handling 1 billion transactions annually.

FinTech and Loyalty Programs

- OnePay Platform: Expanded in 2025, OnePay uses AI for personalized credit and budgeting, targeting underbanked consumers. With 2 million active users, it boosts retention by 8%, generating $1 billion in transactions.

- Walmart+ Growth: AI-driven promotions grow membership to 25 million, rivaling Amazon Prime. Benefits like free delivery increase e-commerce sales by 12%, contributing $80 billion in 2025.

- Digital Coupons: AI personalizes 500 million digital coupons annually, increasing redemption rates by 15%.

Sustainability Initiatives

- Project Gigaton: AI optimizes supply chains, reducing emissions by 10% (2 million tons of CO2) in 2025, saving $500 million annually. Waste reduction in stores aligns with 64% of shoppers prioritizing eco-friendly brands.

- Circular Economy: AI-driven recycling programs in 2,000 stores recover 1 million tons of materials yearly, boosting sustainability ratings by 15% and attracting eco-conscious consumers.

CEO Doug McMillon remarked at the 2025 shareholders’ meeting, “AI is our engine for delivering value at scale, keeping prices low and experiences seamless.” Walmart aims for e-commerce to account for 50% of sales ($340 billion) by 2030.

Competitive Dynamics: Amazon vs. Walmart in 2025

Market Share and Positioning

Amazon’s 37% e-commerce share dwarfs Walmart’s 8-9%, but Walmart’s 4,600 U.S. stores enable one-day delivery to 90% of the population, outpacing Amazon’s two-day Prime standard in rural areas. Amazon’s AWS provides a financial edge, while Walmart’s grocery dominance (25% of e-commerce sales) and 80% in-store pickup penetration give it a convenience advantage. Amazon serves 300 million customers globally, while Walmart reaches 270 million weekly shoppers.

AI Investment and Innovation

Amazon’s $100 billion AI budget, including $20 billion for data centers, outpaces Walmart’s $15 billion. Walmart’s targeted investments yield high ROI, saving $2 billion annually. Amazon’s 9,000+ patents cover broad applications, while Walmart’s 3,000 focus on retail-specific innovations, growing at a 20% rate.

Customer Trust and Data Privacy

In 2025, 61% of shoppers avoid AI tools due to privacy concerns, and 33% distrust AI recommendations. Amazon’s Rufus faces scrutiny for inaccuracies (25% of users reported issues in early 2025), while Walmart’s Sparky increases trust by 15% with its value-aligned tone. Walmart’s Digital Citizenship team limits data collection (preferred by 25% of consumers), and Amazon complies with GDPR and CCPA, processing 1 billion data points daily with encryption.

Workforce and Social Impact

Amazon’s automation, handling 40% of warehouse tasks, reduced fulfillment roles by 5% (50,000 jobs) in 2025, but it retrained 100,000 employees for AI roles. Walmart’s Associate super agent boosts productivity by 20%, but automation cut 5% of e-commerce jobs (20,000 roles). Both face pressure to address job security, as 48% of workers fear AI-driven layoffs.

Pricing and Value Proposition

Amazon’s dynamic pricing, powered by AI, adjusts 10 million prices daily, maintaining a 5% price advantage over competitors. Walmart’s AI-driven pricing ensures 95% of products are at or below market averages, appealing to cost-conscious shoppers (60% of its customer base).

Broader Implications for the Retail Industry

Setting Industry Standards

Amazon and Walmart’s AI advancements drive adoption, with 82% of retailers planning increased AI spending in 2026. Target’s AI logistics reduce out-of-stocks by 15%, while Kohl’s AI pricing boosts margins by 5%. Best Buy’s AI-driven delivery achieves 10% faster times, reflecting industry-wide shifts. As Gary Hawkins notes, “Amazon and Walmart are forcing retailers to adopt AI or face obsolescence.”

Supply Chain Transformation

AI addresses supply chain challenges, with 59% of retailers reporting disruptions in 2025. Amazon’s Wellspring and Walmart’s Trend-to-Product systems reduce waste by 15% and 12%, respectively, saving $2.5 billion combined. Global supply chain costs are projected to reach $20 trillion by 2030, making AI critical for efficiency.

Evolving Consumer Expectations

AI drives demand for speed and personalization. In 2025, 69% of shoppers prioritize delivery speed, and 27% prefer AI recommendations. Amazon’s same-day delivery (20% of urban orders) and Walmart’s one-day reach (90% of U.S. population) raise expectations, forcing competitors to invest in AI logistics.

Sustainability and Ethical Challenges

Amazon’s electric vans reduce emissions by 5% (1 million tons of CO2), targeting net-zero by 2040. Walmart’s AI-driven waste reduction cuts emissions by 10%, saving $500 million. Ethical concerns, including job displacement and data privacy, persist, with 29% of consumers wary of over-personalization.

Social and Economic Impact

AI-driven retail is creating 1 million new jobs globally (e.g., AI trainers, data analysts) while displacing 500,000 traditional roles. Amazon and Walmart’s innovations contribute $50 billion to U.S. GDP annually, driving economic growth but raising concerns about income inequality.

Challenges and Risks

Regulatory and Geopolitical Pressures

Amazon faces FTC scrutiny over AWS and marketplace practices, with a 2025 investigation potentially leading to $10 billion in fines. Walmart navigates tariffs on Chinese imports (10-20% in 2025), increasing costs by $1 billion. President Trump’s 2025 AI leadership order emphasizes domestic production, impacting both companies’ supply chains. Data privacy laws, with 25% of consumers demanding minimal data collection, require compliance with GDPR and CCPA.

Competitive Threats

Target’s AI logistics reduce out-of-stocks by 15%, while Shopify’s AI tools support 2 million merchants, capturing 5% of e-commerce. In-house chip development by Microsoft and Alphabet could reduce reliance on Nvidia’s GPUs, impacting Amazon’s AWS. Walmart’s localized fulfillment strengthens its rural dominance, serving 100 million rural customers.

Consumer Adoption Barriers

61% of consumers hesitate to use AI tools, citing privacy and accuracy concerns. Amazon and Walmart must improve recommendation accuracy (33% distrust AI suggestions) and transparency to drive adoption.

Infrastructure and Energy Demands

AI data centers consume 1% of U.S. energy, with Amazon and Walmart investing $25 billion combined in 2025. Scaling AI requires $5 trillion in global infrastructure by 2030, straining power grids and raising sustainability concerns.

Opportunities for Growth

Amazon’s Opportunities

- Healthcare Expansion: AI-driven healthcare could capture 10% of the $4 trillion U.S. market by 2027, with One Medical serving 5 million patients and generating $200 billion.

- Project Kuiper: Satellite broadband will reach 10 million rural customers by 2027, adding $50 billion in e-commerce revenue.

- Global Markets: AI-driven localization in India (50 million users) and Southeast Asia could add $100 billion by 2030.

- Advertising Growth: AI-driven ads could generate $75 billion by 2027, leveraging 1 billion daily impressions.

Walmart’s Opportunities

- E-Commerce Growth: Targeting 50% of sales ($340 billion) from e-commerce by 2030, driven by AI personalization.

- Gen Z Engagement: Immersive Commerce APIs on Roblox and TikTok target 50 million U.S. Gen Z consumers, boosting sales by 10%.

- Sustainability Leadership: Project Gigaton could attract 64% of eco-conscious shoppers, adding $20 billion in revenue.

- Global Expansion: AI-driven supply chains in 20 markets could increase Walmart’s global reach to 300 million weekly customers by 2030.

Industry-Wide Opportunities

AI-driven retail could add $1 trillion to global GDP by 2030, with innovations in AR shopping, autonomous delivery, and predictive analytics creating new revenue streams. Small retailers adopting AI could see 10-15% revenue growth, leveling the playing field.

The Future of Retail: Amazon and Walmart’s AI Roadmap

Amazon’s Vision

Amazon aims for $120 billion in AWS revenue by 2027, with Prime Air covering 20% of U.S. urban markets (10 million deliveries monthly). AI-driven healthcare and Project Kuiper will expand its ecosystem, targeting 500 million global customers by 2030. Innovations like AI-generated product designs could reduce time-to-market by 20%, adding $50 billion in revenue.

Walmart’s Vision

Walmart’s “Adaptive Retail” strategy will launch AI-driven homepages for every shopper in 2026, boosting e-commerce to $340 billion by 2030. Virtual shopping on Roblox and TikTok will engage Gen Z, while global expansion targets 300 million weekly customers. AI-driven supply chains could save $5 billion annually by 2030.

Industry Transformation

The AI retail market’s $85 billion projection by 2030 underscores Amazon and Walmart’s influence. As Kiran Raj from GlobalData states, “AI is the backbone of retail’s future—those who lead will shape the next decade.” Competitors must adopt AI to survive, with 50% of retailers projected to implement AI by 2027.

Investment Outlook: Amazon and Walmart in 2025

Amazon’s Stock Performance

Amazon’s stock, at $182 in August 2025, reflects a 20% year-to-date gain, driven by AWS ($92 billion in 2024) and AI investments. Analysts project a $220 target by mid-2026, implying a $2.5 trillion market cap. Regulatory risks and high AI spending (25% of revenue) could limit upside, with a price-to-earnings (P/E) ratio of 35x.

Walmart’s Stock Performance

Walmart’s stock, at $73, has risen 15% in 2025, supported by e-commerce growth (20% of sales) and AI efficiencies. Analysts forecast a $90 target by 2026, implying a $750 billion market cap. Its 2% dividend yield and grocery dominance (25% of e-commerce) appeal to value investors, with a P/E ratio of 25x.

Investor Considerations

Amazon’s high-growth potential (35x P/E) contrasts with Walmart’s stability (25x P/E). Investors should weigh Amazon’s tech-driven upside against Walmart’s omnichannel resilience, considering risks like regulation, tariffs, and competition. A balanced portfolio could include both, with Amazon offering 20% upside and Walmart 15% with lower volatility.

Case Studies: Real-World Impact

Amazon Case Study: Prime Day 2025

Amazon’s Prime Day 2025, powered by AI, generated $14 billion in sales, up 12% from 2024. Rufus recommended 100 million products, boosting conversions by 15%. AI-optimized logistics delivered 10 million same-day orders, reducing costs by $500 million. The event attracted 5 million new Prime members, showcasing AI’s impact on scale.

Walmart Case Study: Back-to-School Campaign 2025

Walmart’s AI-driven back-to-school campaign used Sparky to create 1 million personalized shopping lists, increasing basket size by 15% ($20 average). VizPick reduced inventory processing time by 25%, saving $100 million. The campaign generated $5 billion in sales, with 10% from e-commerce, highlighting Walmart’s omnichannel strength.

Consumer Perspectives: Voices from the Market

- Urban Shopper (New York, 28): “Amazon’s same-day delivery and Rufus make shopping effortless, but I worry about data privacy.”

- Rural Shopper (Texas, 45): “Walmart’s one-day pickup and Sparky help me save time and money, especially for groceries.”

- Gen Z Consumer (California, 20): “Walmart’s AR try-ons on my phone are fun, but Amazon’s Prime Video keeps me hooked.”

Conclusion: A New Retail Paradigm

Amazon and Walmart’s AI-driven strategies are redefining retail, blending hyper-personalization, operational efficiency, and innovation. Amazon’s e-commerce and cloud dominance provide a financial edge, while Walmart’s omnichannel model and localized innovations challenge its lead. As they set new standards in the $5.7 trillion U.S. retail market, retailers must balance AI adoption with consumer trust, sustainability, and ethical considerations to thrive. The AI revolution, led by these giants, signals a future where technology drives every aspect of commerce, creating unprecedented opportunities and challenges.

Call to Action

Explore how Amazon and Walmart are shaping retail’s future with AI. Share your thoughts on their strategies in the comments, and subscribe for the latest insights on retail and technology trends shaping 2025 and beyond.

See more: